Physical Address

304 North Cardinal St.

Dorchester Center, MA 02124

Physical Address

304 North Cardinal St.

Dorchester Center, MA 02124

When merchants or companies open on the Internet, they start with a contract with one or two payment processors. But as they grow and expand into new areas, they often need to scale up additional businesses to meet customer needs (and sometimes regulatory requirements), a process that comes with some challenges.

This has led to companies helping to run the project. in Egypt MoneyHash – which helps merchants in the Middle East and Africa manage complex payment piles with ease – has raised $5.2 million as it steps up to partner with large businesses. The pre-Series A comes about a year after its last investment, when it announced a seed round of $4.5 million in February 2024. In total, MoneyHash has raised more than $12 million since then Nader Abdelrazik and Mustafa Eid launched an Egyptian fintech in early 2021.

The area in which MoneyHash operates is described as a “payment system”, and in a decentralized world of payments – where a business can work with different providers to receive, make and pay a bank – its star has risen with the growth of the Internet. actions. Integrating multiple payment stacks can be inefficient and technically demanding, often taking technical teams weeks to complete. These problems are particularly evident throughout Africa and the Middle East due to different payment methods and currencies. This is where payment systems come in by integrating and simplifying these payment systems across platforms through APIs.

Abdelrazik and Eid founded MoneyHash after years of working in fintech and business software and witnessing other challenges. Simply put, wages are (perhaps ostensibly) the foundation of how a business operates, grows and makes a profit. But most of the time the replacement was expensive and dangerous, especially for small traders: the failure of payment in the region is three times the international rate and the abandonment of the cart is more than 20% higher than in developed markets. They saw calling as a solution to this problem: in their opinion, entrepreneurs without paid calling platforms are at the mercy of operating costs, lower income and it is difficult for them to expand all territories.

“The opportunity to solve this is huge,” said CEO Abdelrazik. “In emerging markets, digital currencies represent only a small part of the total volume of transactions, which show significant growth in the next decade. We have created MoneyHash specifically to help merchants overcome these difficult challenges and turn payments into profits.

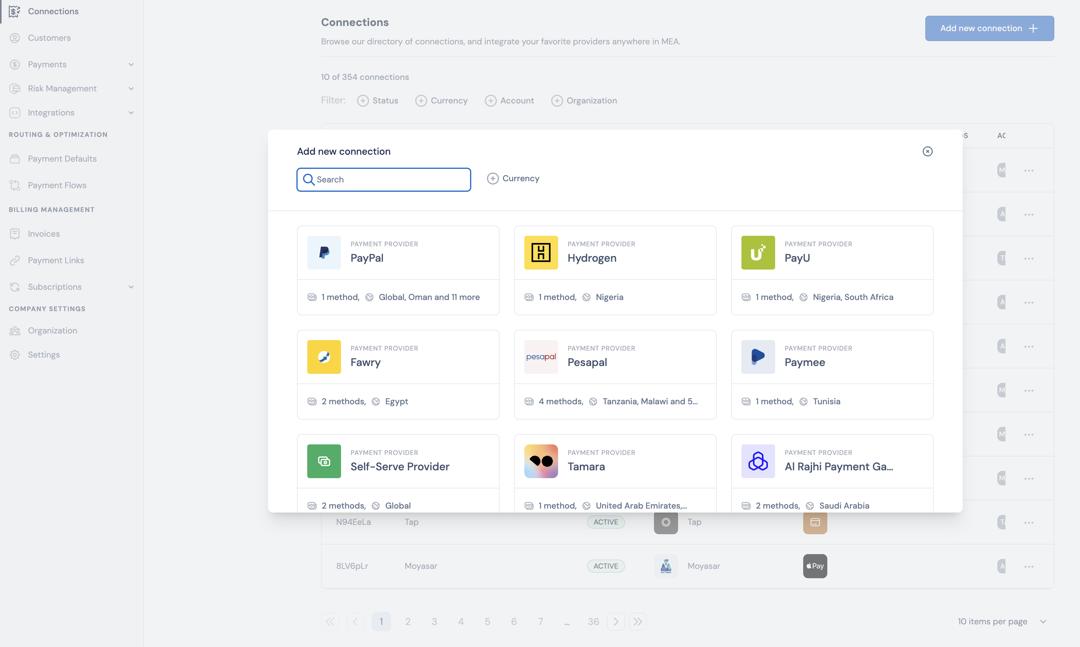

MoneyHash integrates with merchants to provide its customers with an easy way to work across the board. It features features such as a unified billing and payment API, customizable returns, advanced fraud prevention, failover optimization, and detailed reporting tools. The company also supports recurring payments, virtual wallets, subscription management, and payment links, providing an “all-in-one solution” for merchants, it said.

As you have a16z-backed FeesSpreedly, Zooz and Primer in the US, UK, and Europe, MoneyHash supports customers in the Middle East and Africa. Abdelrazik said that is what distinguishes MoneyHash: it focuses on emerging markets and its integrated network, which includes more than 300 APIs (with local and international processors and gateways such as Adyen, Amazon Pay, Checkout, Fawry, Mono, Stripe , Tabby). , and ValU) covering 100+ markets. QED-backed Pricea South African startup, offers similar services in the region.

MoneyHash initially focused on small traders but began to focus on large businesses in early 2024 and set up its own business, a move that has allowed the company to become more successful.

“Without us, you can still do a lot of extensions that would take years of work and learning. But when you add our programs, all the tests you pay for reach a higher level. We are talking about permission, conversion, and fraud rates. And we are more,” said CEO Abdelrazik.

“We’re not just looking for a single solution to try to solve all problems throughout the payment cycle, which is what businesses need. Companies don’t want to solve one problem. They’re not looking for other problems. They want a complete solution throughout the payment cycle, and that’s what we do.”

Businesses in industries such as consumer fintech, hospitality, e-commerce, and gaming now make up 35% of MoneyHash’s customers, a three-fold increase in 2024. Key customers include BNPL unicorn Tamara, cloud kitchen leader Kitopi, and e-commerce platform Brands For Less. .

According to the head of payments at Tamara, MoneyHash is well known in the region for “making a significant difference,” perhaps referring to what it says is helping clients achieve a 10-20% increase in revenue while undercutting the market. and the cost of development is 90%.

Meanwhile, Abdelrazik credits his startup and long-term contracts with helping to raise pre-Series A funding. He said these clients fueled a 4x increase in production volume and a 3x increase in revenue last year, although the exact numbers are unknown.

Global fintech investor Flourish Ventures led the round. Other investors include Saudi Vision Ventures, Arab Bank Xelerate and Emurp Kepple Ventures. The round also received participation from Jason Gardner, founder and former CEO of Marqeta (his first foray into the space), as well as existing investors Github founder Tom Preston-Werner and COTU Ventures.