Physical Address

304 North Cardinal St.

Dorchester Center, MA 02124

Physical Address

304 North Cardinal St.

Dorchester Center, MA 02124

Special Counsel David Weiss’ final report on his years of research into Hunter Biden determined that the first son’s drug abuse could not explain his failure to pay taxes on millions of dollars of income earned on his “surname and connections.”

“As a well-trained lawyer and businessman, Mr. Biden knowingly and voluntarily chose not to pay at least $1.4 million in taxes over a four-year period. From 2016 to 2020, Mr. Biden received more of $7 million in total gross revenue, including approximately $1.5 million in 2016, $2.3 million in 2017, $2.1 million in 2018, $1 million in 2019 and $188,000 from January to October 15, 2020,” Weiss wrote in his final report, which was released Monday.

“Mr. Biden earned this money by using his last name and connections to secure lucrative business opportunities, including a board seat at a Ukrainian industrial conglomerate, Burisma Holdings Limited, and a joint venture with individuals associated with the conglomerate Chinese energy. He negotiated and executed contracts and agreements that paid him millions of dollars for limited work,” Weiss continued.

Hunter Biden, 54, had a busy year in court last year, when he he was convicted in two separate federal cases processed by Weiss. He began his first trial in Delaware in June, when he faced three firearms charges related to his drug use, before pleading guilty to another felony charge in September.

DOJ RELEASES SPECIAL COUNSEL DAVID WEISS’S REPORT ON HUNTER BIDEN

Hunter Biden, son of US President Joe Biden, and his wife Melissa Cohen Biden leave the J. Caleb Boggs Federal Building on June 7, 2024 in Wilmington, Delaware. Hunter Biden’s trial on felony weapons charges continues today with additional testimony. (Photo by Kevin Dietsch/Getty Images) (Kevin Dietsch/Getty Images)

Hunter Biden’s September trial revolved around charges of three tax felony counts and six tax felony counts of failure to pay at least $1.4 million in taxes. However, as jury selection was about to begin in Los Angeles federal court for the case, Hunter Biden surprisingly pleaded guilty.

Weiss continued in his report that Hunter Biden “spent millions of dollars on an extravagant lifestyle instead of paying his taxes” and that he “willfully failed to pay his 2016, 2017, 2018 and 2019 taxes on time. , despite having access to funds to pay some or all of these taxes.”

Weiss added that the first son’s past drug abuse could not explain his failure to pay taxes.

HUNTER BIDEN: A LOOK AT HOW THE SAGA DEVELOPED OVER SIX YEARS

“These are not ‘inconsequential’ or ‘technical’ violations of the tax code,” Weiss wrote. “Nor can Mr. Biden’s conduct be explained by his drug use; most obviously, Mr. Biden filed his false 2018 tax return, in which he deliberately understated his income to reduce his tax liability, the February 2020, approximately eight months after he regained his sobriety, therefore Mr. Biden’s prosecution was warranted given the nature and seriousness of his fiscal crimes.”

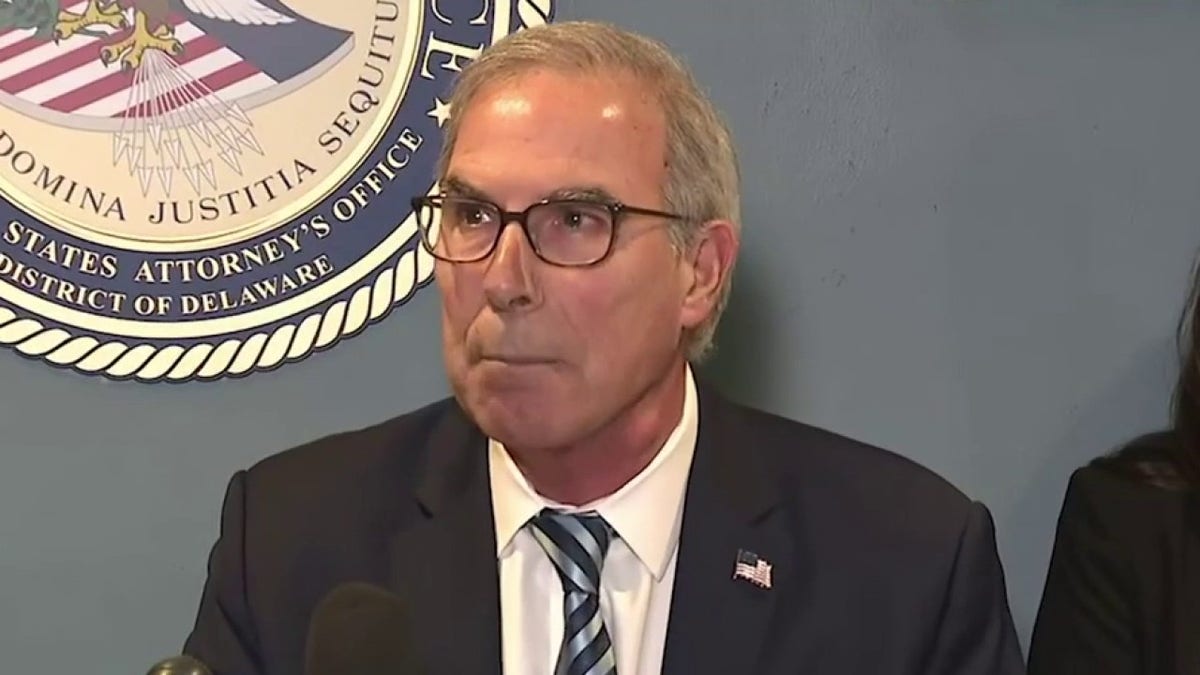

U.S. Attorney for the District of Delaware David C. Weiss. (Screenshot from Fox News)

Hunter has a well-documented record history of drug abusewhich was most notably documented in his 2021 memoir, “Beautiful Things.” The book showed readers his former addiction to cocaine, before he got sober in 2019. The memoir featured widely in his separate firearms case in June, when a jury found him guilty of three felony charges related to his purchase of a gun while addicted to substances.

BIDEN SORRY SON HUNTER BIDEN OUTSIDE THE OVAL OFFICE EXIT

“The evidence showed that because Mr. Biden held high-paying positions that earned him millions of dollars, he chose to continue to fund his extravagant lifestyle instead of paying his taxes. He then chose to lie to his accountants claiming false business deductions when, in fact, he knew they were personal expenses. He did so on his own account and his return preparers trusted him, because, among other reasons, only he understood the true nature of his deductions and did not give them records that might have revealed the deductions were false,” Weiss continued.

The prosecutors charged up to 17 years behind bars, but the first son likely would have faced a much shorter sentence under federal guidelines. His sentence was scheduled for December 16, but he was pardoned by his family father, president biden, at the beginning of that month.

BIDEN WILL NOT PARDON HUNTER, WHITE HOUSE REAFFIRMS, BUT CRITICS NOT SO SURE

Hunter Biden’s blanket pardon spanned a decade that applied to any crime he “committed or may have committed” at the federal level.

FILE – President Joe Biden, wearing a Team USA jacket and walking with his son Hunter Biden, heads to Marine One on the South Lawn of the White House in Washington, July 26, 2024 . (AP Photo/Susan Walsh, file)

Weiss’s report also took issue with the president’s pardon of Hunter Biden, specifically how President Biden called Hunter Biden’s prosecutions “selective” and “unfair.”

HUNTER BIDEN HAS BEEN FOUND GUILTY OF ALL ACTS IN GUNS TRIAL

“This statement is gratuitous and incorrect,” Weiss wrote in his report. “Other presidents have pardoned family members, but in doing so, none has taken the opportunity to smear public officials in the Department of Justice based solely on false accusations.”

“Politicians who attack the decisions of career prosecutors as politically motivated when they disagree with the outcome of a case undermine public confidence in our criminal justice systemWeiss wrote in another section of the report. “The president’s statements unfairly impugn the integrity not only of the staff of the Department of Justice, but of all public officials who make these difficult decisions in good faith.”

CLICK HERE TO GET THE FOX NEWS APP

The DOJ sent Weiss’s report to Congress on Monday evening, officially closing the years-long investigation into the first child.

Fox News Digital’s Brooke Singman contributed to this report.