Physical Address

304 North Cardinal St.

Dorchester Center, MA 02124

Physical Address

304 North Cardinal St.

Dorchester Center, MA 02124

Subscribe to our daily and weekly newsletters for the latest updates and content from the industry’s leading AI site. learn more

There is a raft of US unicorns — those valued at $1 billion or more — are expected to go public in 2025, according to the PitchBook/NVCA Venture Monitor for the fourth quarter of 2024.

The folks at PitchBook have a VC exit guide, a tool that leverages machine learning and PitchBook’s company database, providing funding rounds and investors to better assess startups for successful exits.

On the PitchBook platform, VC-backed companies are given a high score for being acquired, going public, not going out of business, or being self-sustaining. In order to provide a clearer picture of the true cost of exiting the VC market, the researchers have added an equity method used for M&A transactions not covered in our PE and Global M&A reports.

Nizar Tarhuni, EVP of Research and Market Intelligence at PitchBook, said in a statement, “Even in 2024 there was a slight increase in the number of completed investments and the number of dollars invested – an increase in the focus on AI at large prices. Many businesses are facing regulatory challenges.”

He said that, in the end, the VC scene lacks clear results, led by many problems including the price mismatch between buyers and sellers from previous price increases and strong regulation that hinders the market’s interest in the main market.

“Our outlook for 2025 is very positive. More M&A and a friendly presence in Washington, plus more time for start-ups and investors to adjust their expectations for prices, businesses and growth will help attract more capital to leave,” said Tarhuni. “That said, fundraising can be lukewarm, especially as some pockets of the market seem to be getting more aggressive, competing for dollars in other allocator positions, and favoring larger platforms and established managers.”

And Bobby Franklin, CEO at NVCA, said in his statement that, after a long period of high investment from mid-2022, there is a cautious outlook for VCs and businesses coming into 2025.

“Leadership changes at the FTC and DOJ could reduce the pressure on companies, and changes at the SEC could increase the burden on businesses,” he said. “With so many VCs entering public office and actively involved on Capitol Hill, venture capital firms have a unique opportunity to demonstrate the critical role of venture capital firms in advancing economic growth and maintaining America’s competitiveness.”

He said the tax bill passing through Congress is very important, as it can boost innovation, restore the R&D tax credit, and help the environment as a whole.

Among US tech unicorns with IPO chances, PitchBook predicts Anduril, the aerospace and defense company founded by Oculus founder Palmer Luckey, to have a 97% chance of going public in 2025.

Another with gaming roots is Mythical Games, a Web3 game company led by John Linden. The company has a 97% chance of going public in 2025.

Others include Ayar Labs, Carbon, Databricks, EquipmentShare, Form Energy, GrubMarket, Mainspring, Sila and StockX. Those with a 96% chance of going public include Impossible Foods, Groq and SpaceX.

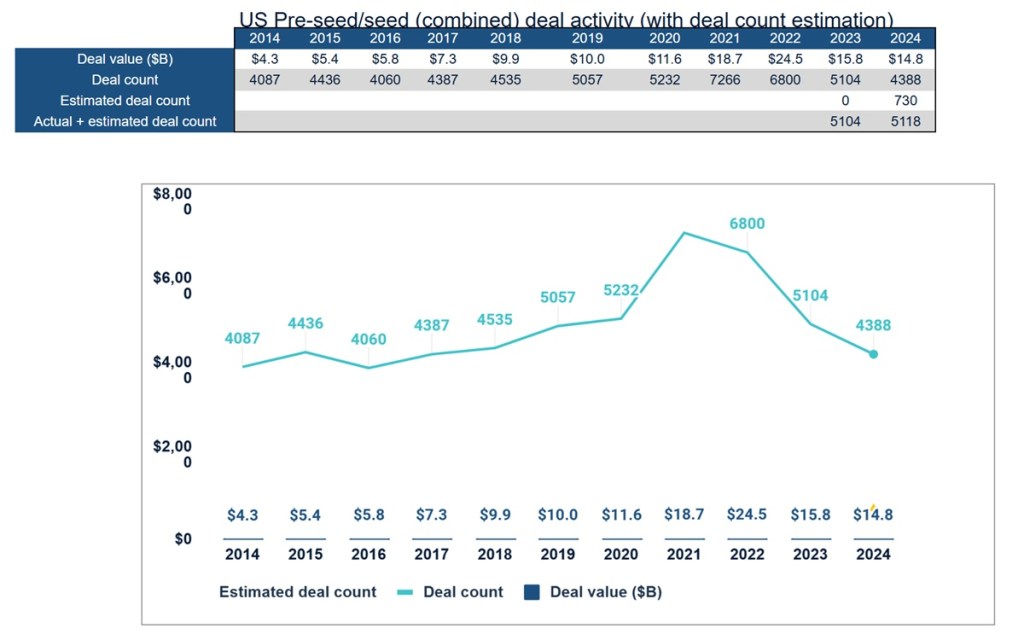

In 2024, the largest group of funding and size was $1 million to $5 million raised, with 3,153 founders in this group. This is down from 3,781 in 2023 and 5,310 in the peak year of 2021.