Physical Address

304 North Cardinal St.

Dorchester Center, MA 02124

Physical Address

304 North Cardinal St.

Dorchester Center, MA 02124

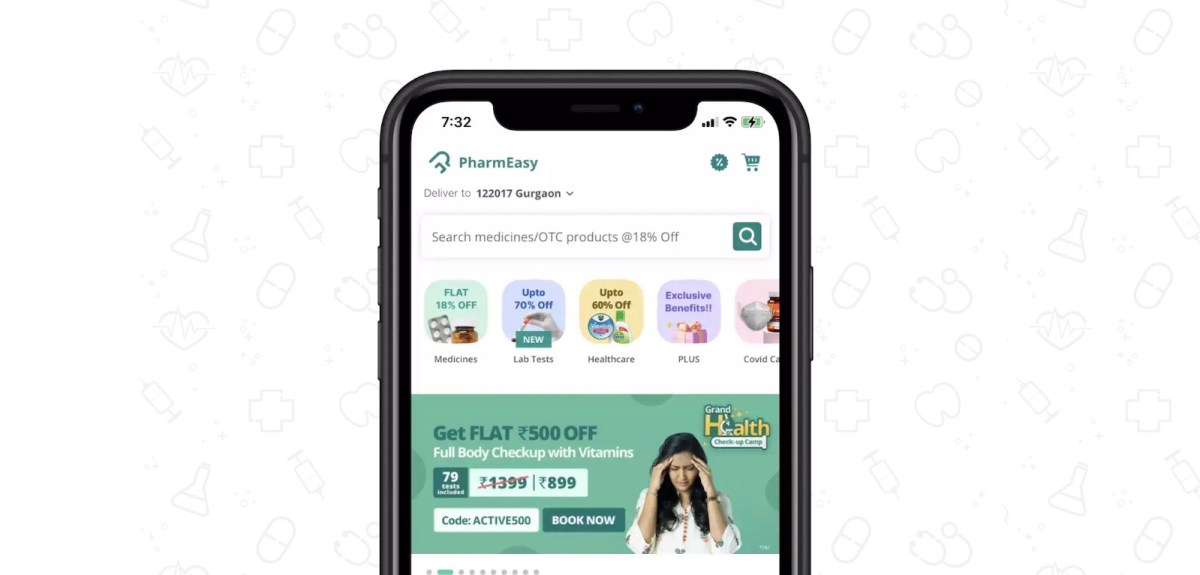

Indian pharmacy operator PharmEasy is now worth about $456 million, according to Janus Henderson disclosures, a 92% drop from its peak value of $5.6 billion.

British American Global Research Fund sees it owning 12.9 million shares in PharmEasy at $766,043, according to its most recent filing at the end of September. The fund originally spent $9.4 million to buy the shares.

The persistence in lowering costs it comes despite the fact that PharmEasy raised more than $200 million in new funding earlier this year and plans to give public debut next yearTechCrunch previously reported.

This follows the launch of PharmEasy freedom issue in 2023 amid financial crisis and debt repayment obligations. A rights issue allows companies to raise capital by giving shareholders the opportunity to buy stock at a discount. Depending on the terms, shareholders may also be disenfranchised from their previous holdings if they do not participate in the rights issue.

PharmEasy raised $417 million through an oversubscribed rights offering, according to PharmEasy co-founder Dharmil Sheth. An official filing in April 2024 showed that the startup had raised about $216 million.

The startup, backed by Prosus, Temasek, TPG and B Capital, operates one of the largest online pharmacies in India. The latest valuation places PharmEasy in the bottom line the $600 million it paid to buy the Thyrocare lab in 2021. Pharmeasy has raised over $1 billion to date.

The startup’s financial problems became apparent after it canceled an IPO of $843 million that had been planned for November 2021. It then turned to debt financing, including a $300 million loan from Goldman Sachs that became difficult as the company struggled to repay and raise new capital in a booming market.